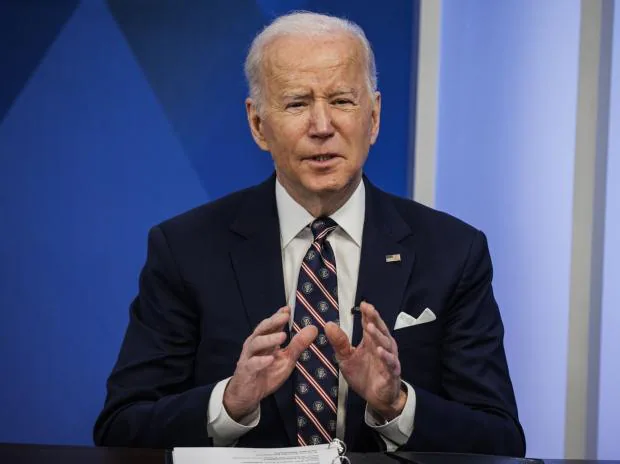

According to US President Joe Biden’s budget proposal, a nonagenarian, a father of seven, and a well-known divorcee would be liable to a new minimum tax.

The concept aims to take a bigger piece of the recent stock market boom’s wealth. It is targeted at approximately 20,000 US taxpayers with a net worth of more than $100 million (£76 million).

Warren Buffett, Elon Musk, and Amazon’s founder, Jeff Bezos, would all be affected.

The idea would impose a 20 percent minimum income tax on America’s 0.01 percent wealthiest. It also changes the processes for calculating income to incorporate stock gains. Even if the taxed investor did not sell them.

The idea is the latest in a long line of proposals to raise taxes on the ultra-rich. And it is facing heavy opposition in Washington, as well as opposition from the class it aims to tax.

According to the Boston Consulting Group, there are around 20,600 people worth more than $100 million in the United States.

According to the White House, more than half of the $360 billion raised over ten years will come from the country’s roughly 700 millionaires.

How Joe Biden’s Budget Will Affect Super-Rich?

Elon Musk, the CEO of Tesla and the world’s richest man, tweeted about a similar plan last year. He wrote “Eventually they run out of other people’s money and then they come for you.”

Mr. Musk, a father of seven have a net worth of more than $280 billion. He would have to pay $50 billion more in taxes over 10 years under Mr. Biden’s proposal than under the current system, according to a study by Gabriel Zucman, an economist at the University of California-Berkeley.

Amazon founder Jeff Bezos would be responsible for an additional $35 billion. While Warren Buffett would be responsible for $26 billion.

Mr. Joe Biden’s budget also proposes raising the income tax rate for households earning more than $400,000 from 37 percent to 39.6%, as well as raising the corporate tax rate to 28 percent, reversing some of the Trump administration’s tax cuts.

He would also make big changes to the way stock and property gains are taxed. Which would affect everyone, not just the wealthiest Americans.

The reforms, along with others in the budget, are expected to help lower the deficit by $1 trillion over the next decade, according to the White House.

For the fiscal year 2022, the annual deficit is estimated to be more than $1.2 trillion. The overall debt reached $30 trillion last month.

According to the Brookings Institution, a Washington think tank, America’s 400 wealthiest households have more money than the country’s 10 million black families combined in 2020.

Read More Stories:

Success story: How Elon Musk became CEO

A day in the life of Warren Buffet

Biden’s inflation plan upends thinking on US jobs sent overseas